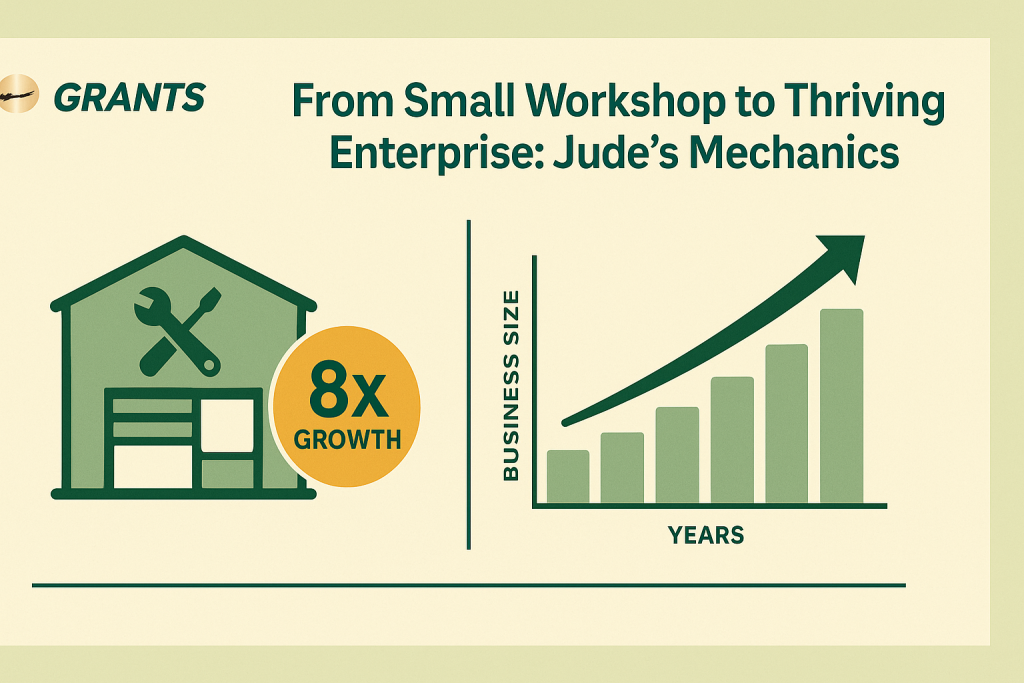

From Small Workshop to Thriving Enterprise: Jude’s Mechanics

Client Profile: Jude A., mechanic and entrepreneur in Gwagwalada, Abuja.

Challenge: Limited growth due to cash constraints.

Solution: Tailored small-business loan.

Results: Expanded to full workshop, hired apprentices, financed a bus fleet.

Testimonial: “Thanks to Grants MFB, I’ve grown from a small mechanic to a successful entrepreneur.”

Global Expansion: Aba Textile Company’s Remarkable Growth

Client Profile: Rapidly growing textile manufacturer in Aba.

Challenge: High costs and rented premises limiting scale.

Solution: Capital for dedicated production facility.

Results: Nationwide distribution and entry into export markets.

Testimonial: “Grants MFB’s support propelled our business onto the global stage.”

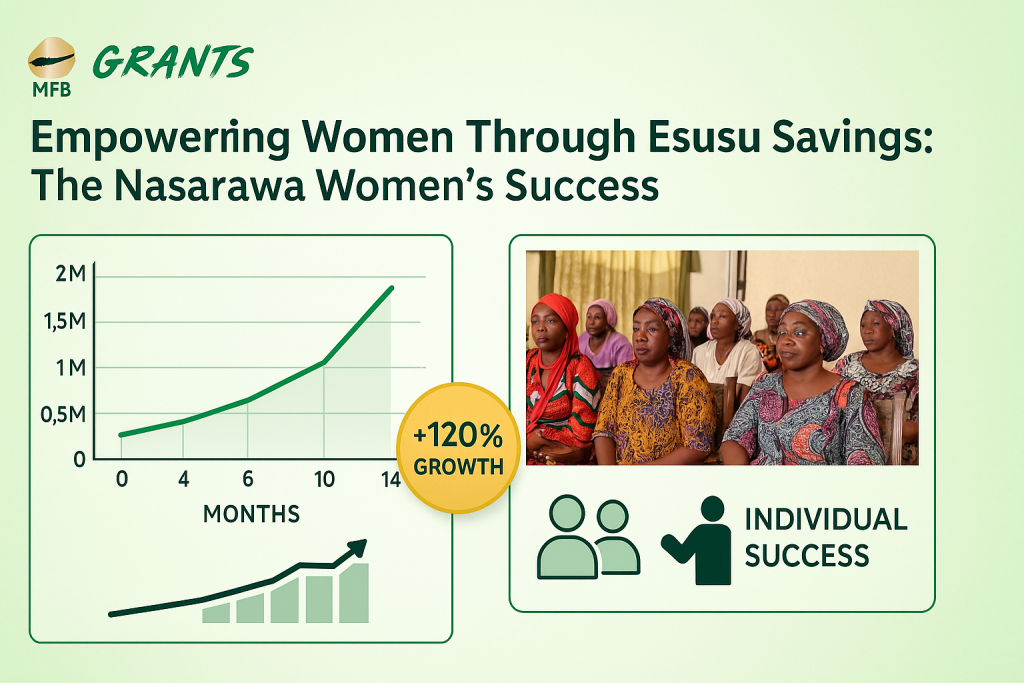

Empowering Women Through Esusu Savings: The Nasarawa Women’s Success

Client Profile: Esusu group of women entrepreneurs in Lafia, Nasarawa.

Challenge: Inconsistent savings, no individual investment capital.

Solution: Structured Esusu program and financial-literacy training.

Results: Pooled savings grew, funding each member’s business.

Testimonial: “Grants MMB helped our savings grow, empowering us.”

Financial Empowerment for Civil Servants: Kuje Cooperative Success

Client Profile: Civil-service cooperative (150+ members) in Kuje, Abuja.

Challenge: Needed large sum for member projects.

Solution: ₦75 million cooperative loan over two years.

Results: 100% repayment; members invested successfully.

Testimonial: “Grants MFB’s support positively impacted every member.”

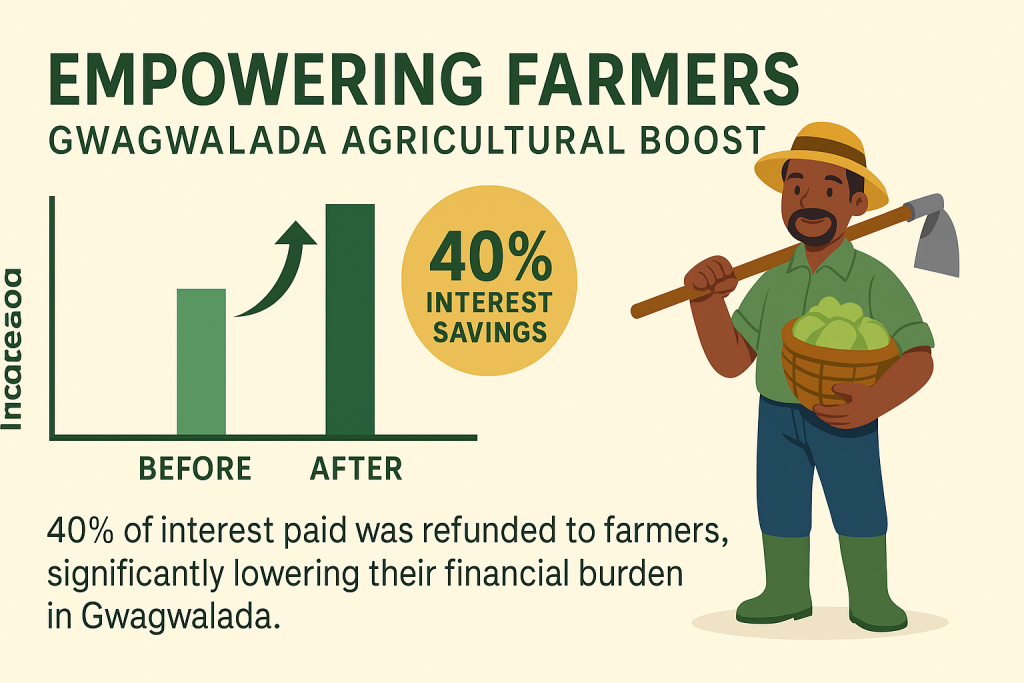

Empowering Farmers: Gwagwalada Agricultural Boost

Client Profile: Over 100 farmers in Gwagwalada, Abuja.

Challenge: High interest rates and limited capital.

Solution: Agri-loan with CBN’s 40% interest-drawback scheme.

Results: Expanded yields; farmers received 40% of interest back.

Testimonial: “Grants MFB and the CBN program made it financially viable for us.”